As tax season approaches, individuals and businesses alike are gearing up to file their returns. The Internal Revenue Service (IRS) offers a range of tools to make the process smoother and more efficient. In this article, we'll explore the essential tools provided by the IRS to help you navigate the world of taxes with ease.

IRS Website and Online Services

The

IRS website is a treasure trove of information and resources for taxpayers. You can access various online services, including:

e-file, which allows you to electronically file your tax return

Get Transcript, which provides access to your tax transcript and account information

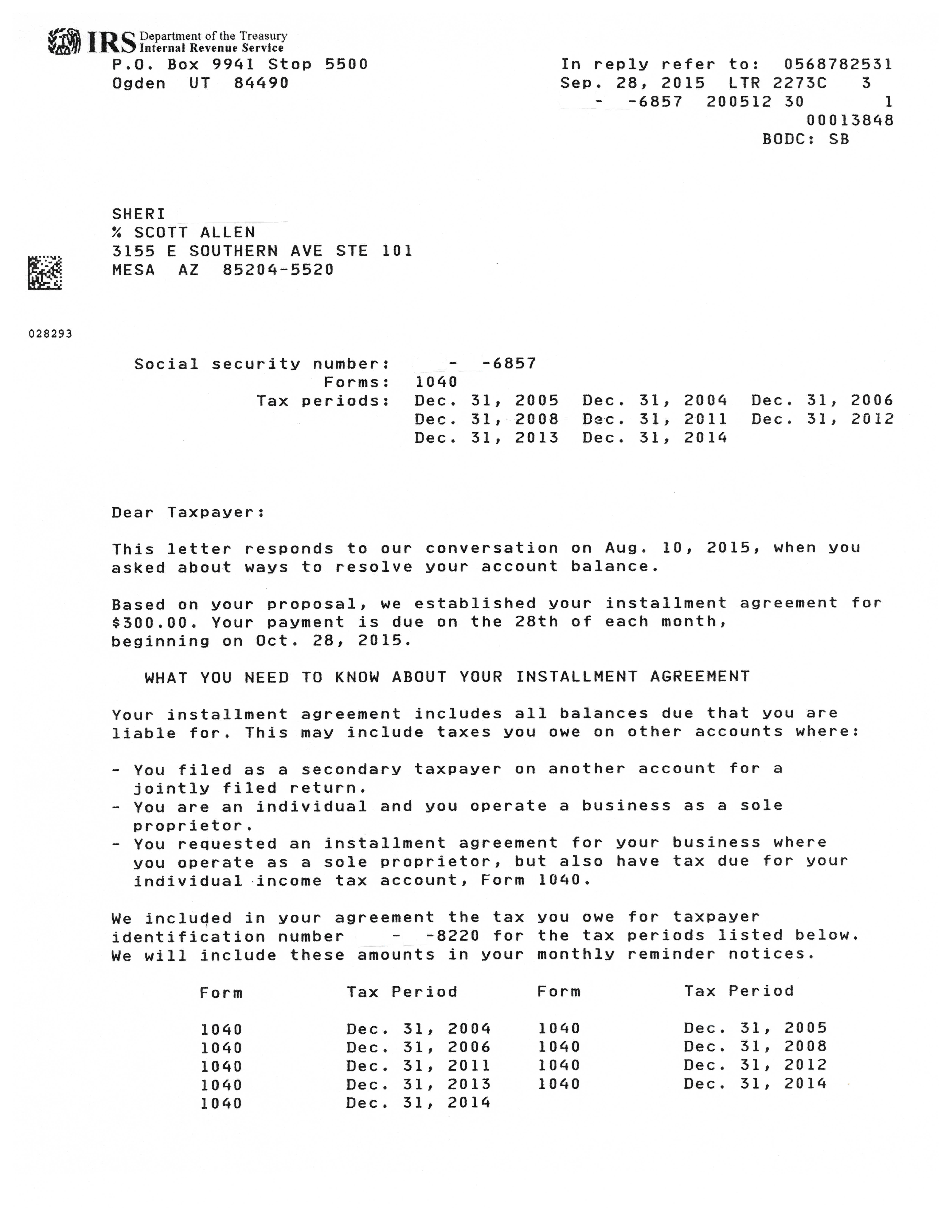

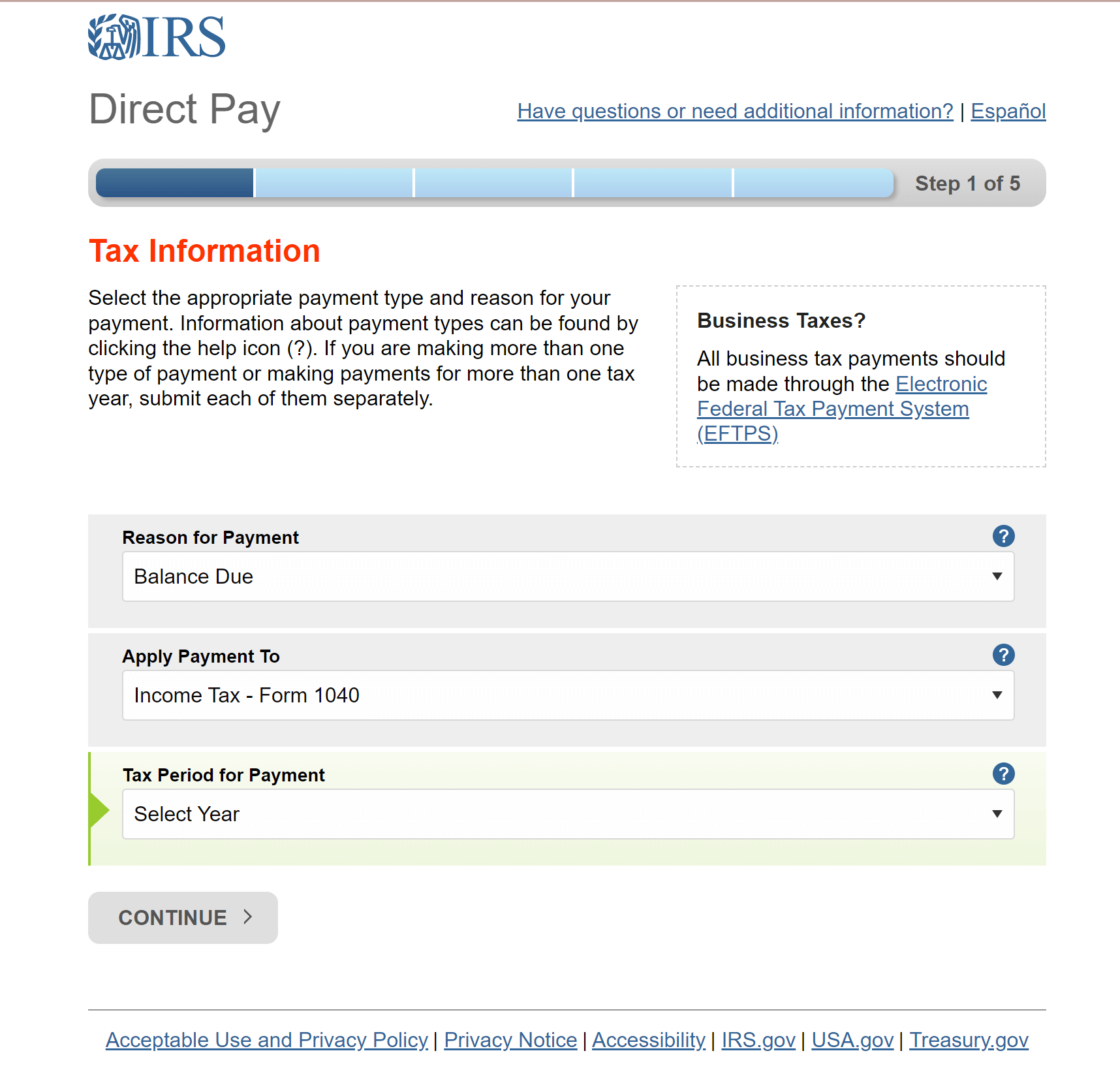

Online Payment Agreement, which enables you to set up a payment plan for your tax debt

Taxpayer Assistance Centers (TACs)

If you need face-to-face assistance, the IRS operates

Taxpayer Assistance Centers (TACs) across the country. These centers offer help with a range of issues, including:

Answering tax law questions

Resolving tax account issues

Providing forms and publications

Accepting tax payments

IRS Mobile App: IRS2Go

The

IRS2Go mobile app is a convenient tool for taxpayers on-the-go. With the app, you can:

Check your refund status

Make a payment

Find free tax preparation services

Get the latest tax news and updates

Electronic Federal Tax Payment System (EFTPS)

The

Electronic Federal Tax Payment System (EFTPS) is a secure online system for making federal tax payments. You can use EFTPS to:

Make individual and business tax payments

Schedule payments in advance

Receive email notifications and confirmations

Taxpayer Identification Number (TIN) Matching

The

Taxpayer Identification Number (TIN) Matching program helps businesses and organizations verify the accuracy of TINs. This tool is essential for:

Reducing errors and rejections

Improving compliance with tax laws

Streamlining the tax filing process

In conclusion, the Internal Revenue Service offers a range of tools to make tax preparation and filing more efficient. From online services and mobile apps to taxpayer assistance centers and electronic payment systems, the IRS has something for everyone. By utilizing these tools, you can ensure a smoother tax experience and avoid common pitfalls. Visit the IRS website today to explore these resources and make tax season a breeze.

Note: The links provided in this article are subject to change, and it's always best to visit the IRS website for the most up-to-date information and resources.

![How to pay your taxes with IRS Direct Pay [Step-by-step guide]](https://www.dimercurioadvisors.com/hs-fs/hubfs/blog-images/137-direct-pay/irs-direct-pay-step-1.png?width=9204&name=irs-direct-pay-step-1.png)